Also, the credit note must be issued within one month of the agreement between the customer and vendor to reduce the invoice amount. The note should also dictate the amount that’s being reduced from the invoice.

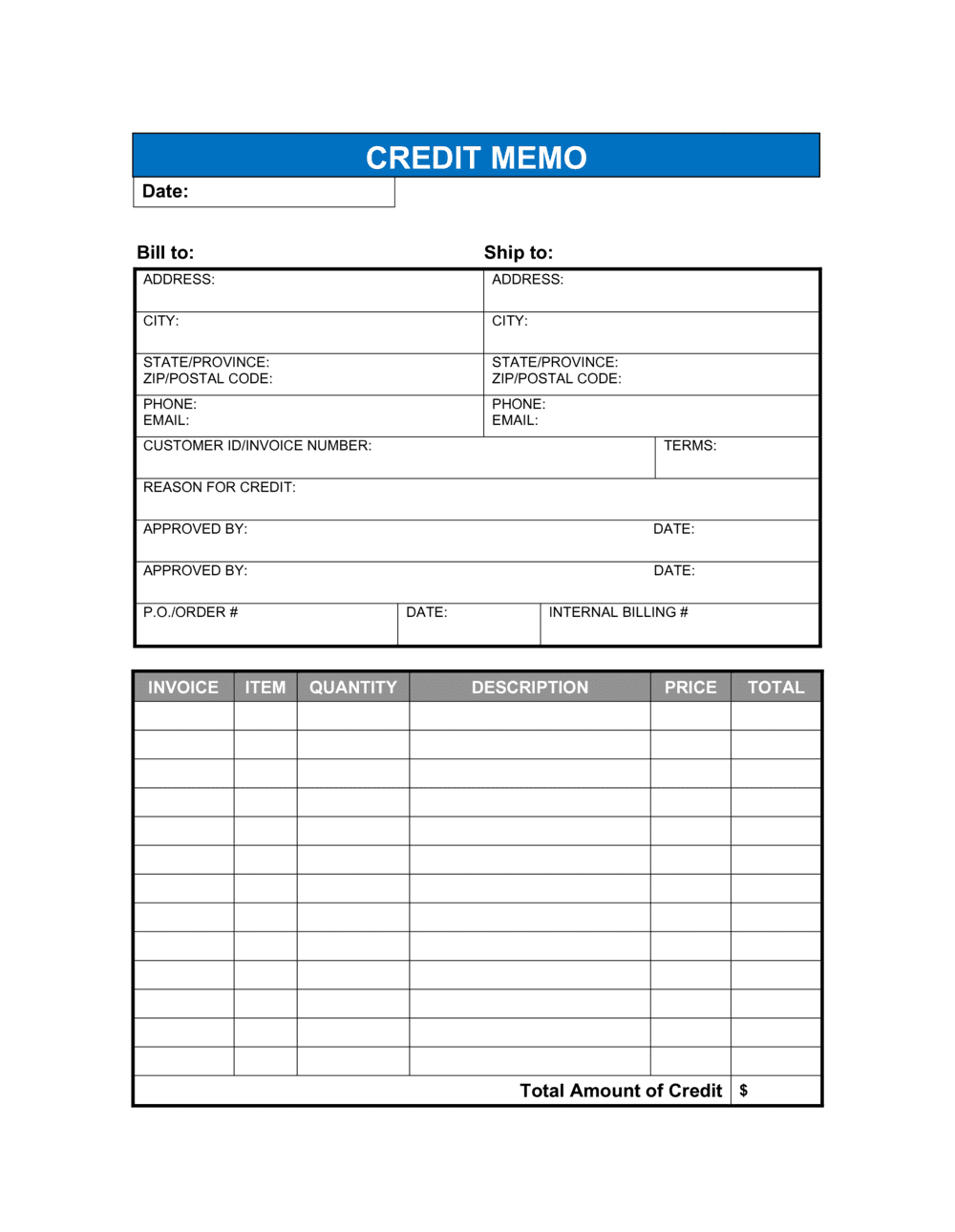

Here’s a quick look at what should be included in your credit note.įirst, you want to make a heading that’s clearly titled as a “Credit Note.” This way, the customer, finance department, company, and any other entities going over your invoices will know what it is. Like a quote or invoice, credit notes must include specific information to be valid. There’s an outline you can use to ensure this.

When creating a credit note, there are key details you should include. This will, in turn, organize your finances and help you track down what happened in the past when invoices were changed or canceled. So when you’re looking to make changes to an order (either by the request of you or the client), then you’ll also have to edit the invoice and reissue it. This clearly details what’s being canceled, why it’s being canceled, and how much is being canceled. The legal way to cancel out some or all of an invoice is with a credit note. It may look like you’re hiding money from your tax authority, which will likely lead to an audit and fines. Not doing so could land you in trouble if you decide to cancel out an invoice improperly. And due to certain laws in different countries, it’s essential to become accustomed to using them. When to Use a Credit NoteĪs we discussed, there are several ways to use a credit note in your business.

#Credit memo update#

In a nutshell, a credit note is used in conjunction with an invoice to update the amount owed to the vendor. The customer returning the items can issue the credit memo to notify the vendor of the discrepancy. If a customer is dissatisfied with the services you provided – you can use a credit note to either cancel it out or to deduct an amount from the total price.

Or if you accidentally send duplicate items or the wrong items, credit notes can be used as well. These are typically used when a customer returns items to the vendor.Īs the vendor, you create a credit note and attach it to the original invoice to nullify it or to subtract the items returned. When done correctly, it can help to avoid disputes and non-payments.Ī credit note or credit memo, on the other hand, is a document you attach to invoices. The invoice serves the purpose of providing customers with a detailed break down of what they must pay. It contains an itemized list of the goods or services, along with a break down of the rates, due date, and total amount owed. An invoice is a document you create to bill your customers for products or services provided. It’s important not to confuse credit notes with invoices. So let’s take a closer look at what a credit note is and why (and when) you should use them. It’s essential to keep it on record but have a credit note attached detailing that it’s either been partially or completely canceled.Īdding this to your sales process is key. You can’t create an invoice and then delete it from existence. There are rules and regulations regarding the cancellation of invoices. Having a numbering system is also critical to ensuring your invoices are properly organized.īut what happens when you need to cancel out an invoice that was either partially paid or unpaid altogether? This is where credit notes come in handy. For example, adopting an electronic invoicing system to help manage all of your clients and bills. This is why we recommend setting up a system in advance to help make the process seamless. As a freelancer or contractor, you may not have the support from a finance department to help ensure this. Creating an organized invoicing system is essential when you’re running a small business.

0 kommentar(er)

0 kommentar(er)